Our Pension Increased 3 Full Points in the Past 12 Years

I recently sat down with Steve Flanagan, the Business Manager of General Building and Construction Laborers Local 66 and Chair of the Local 66 Trust Funds. Steve was excited to brag to me that their Trust Funds (Pension Fund) has experienced four payout increases, 3 full points in the past 12 years.

A trust fund is a fund comprised of a variety of assets intended to provide benefits to an individual or organization. At Local 66, these funds come from their employers for hours worked, as part of a benefit package, and representatives from both the union and the employers oversee these funds. Like most Building Trade unions, Local 66’s funds are self-insured pension plans, also known as Taft Hartley Funds in the Building Trades. Steve has some helpful suggestions for his fellow fund overseers in the union movement, and some even greater news for his active members and pensioners. - Kris LaGrange, UCOMM Blog

The following is the top 4 things to do to maximize your pension fund:

- Educate Your Trustees. Sometimes, many of them don’t know money systems, markets, investments, etc., because they come from the ranks. Your union’s trustees have to be better than the actuaries because sometimes those actuaries are looking to just make a buck or just lighten their workload. So the best ways to educate your trustees are to send them to seminars, read up on the subject matter and encourage them to self-educate themselves.

- Well Fund your Pension. Before you make any changes to your fund, simply just fund it 100%. For example, a good money manager will know when to move the members’ money around from commodities, to real estate; from high risk investments to low risk. This is when knowing and understanding the market comes into play. Lazy money managers won’t call you, good one’s will. As a trustee or as the Chair, you must recognize and know the difference.

- Shorten the Time Frame. Instead of increasing your pensioners hours say back to 1968, you only pay out increases back from the year 2000. This way their pension is locked-in for all the hours they put in before the year 2000 cutoff date. This protects current pensioners, and as a result, all those retirees will still get a 13th check every 3 years, which is bigger than the expected 3% annual increase. At first you will get pushback because of the lack of understanding of how pensions are managed, but those gripes quickly go away when that 13th check comes in.

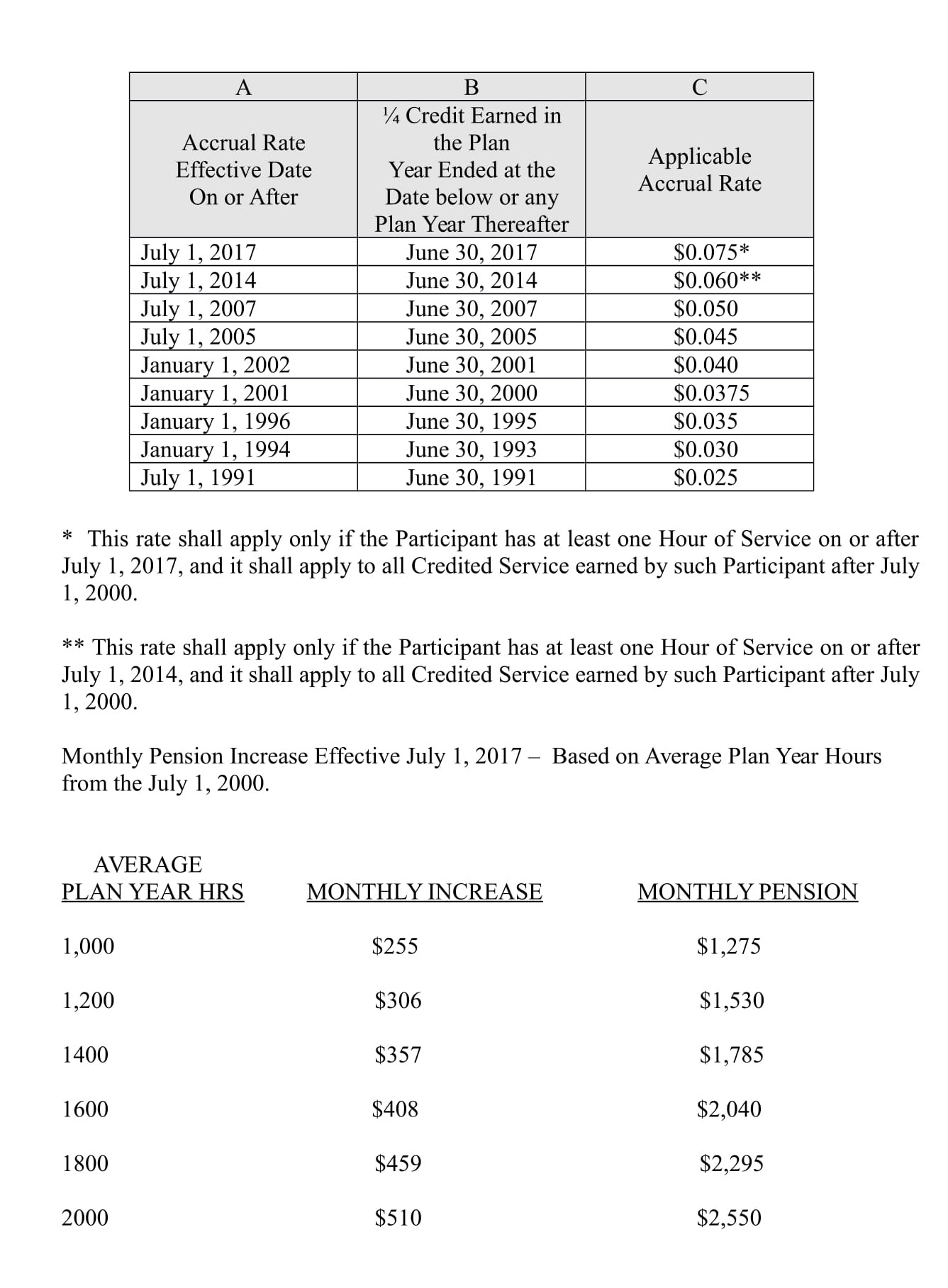

- Increase the Investments. Now that you only have to manage your fund back to all hours contributed back to year 2000, (instead of all the way back to 1968), this will increase the overall funding of the pension fund. This results in bigger increases for all the active members. This is why the fund we manage has a full point and a half increase in three years. What this means for the active members is that the more hours you put in, the bigger your monthly pension check is. Check out the example in the graphic below.

The result of this is an overall happy membership and retirees. Pension Funds are never easy to explain. In the end the retirees love the consistency and the protection of the fund they spent their entire lives contributing to. That 13th check is golden and on top of that, it’s real nice to report back to the membership at union meetings that their pension fund is growing above regular expectations. Our members work hard, entrust us to protect their retirement security, and as the steward of their money, taking the time and energy to do these 4 simple steps is the least we can do.